As a rule, when considering income taxes, plenty of people don’t understand why they need to work with a professional. The actuality clearly indicates that since you don’t have knowledge of a particular subject, the chances of achieving success are practically absent. The legal field is quite elaborate, meaning that not every person could have to deal with the many different situations which involve precise understanding of the laws and procedures. It’s factual that when you complete a certain thing yourself, it will save you from supplemental expenses, but it’s incorrect in case you don’t really know what it means to deal with taxes. An unprepared contribution may bring undesirable problems. What is seen at first sight may differ so much from real life. That is why, if so far you have been assured that you can deal with it yourself without having any earlier experience, it’s the right time to modify your strategies. First of all, you must know that working with a Tax Adviser is absolutely not one additional expenditure. Many people get to understand this only just after an unsuccessful personal past experience, which you definitely do not want.

Owning and running a business needs a great deal of effort. Many people are oriented towards success, but dealing with particular levels makes work even more complicated. This is basically the case when you take on the duty of tax planning with no sufficient experience. Although the desire to handle specific tasks personally starts up from a noble reason in order to save resources, you can still come to understand that too much saving takes you to a different one, clearly unfavorable extreme. Running a business demands the participation of some essential individuals, and tax return preparers are some of them. So, since you realize that taxes are not your area of experience, the most fair move to make will be to seek out the services of a Personal Tax Accountant. Financial integrity is not just about major enterprise – businesses of any size are on target. Long-term achievements necessitates a tactic but also confidence that the financial circumstances is fine. The team, no matter how small it happens to be, when it is comprised of the right individuals, there is no way it will not succeed in the proposed objectives. Make time to consider the circumstance and that could help you save from a lot of pointless potential risks.

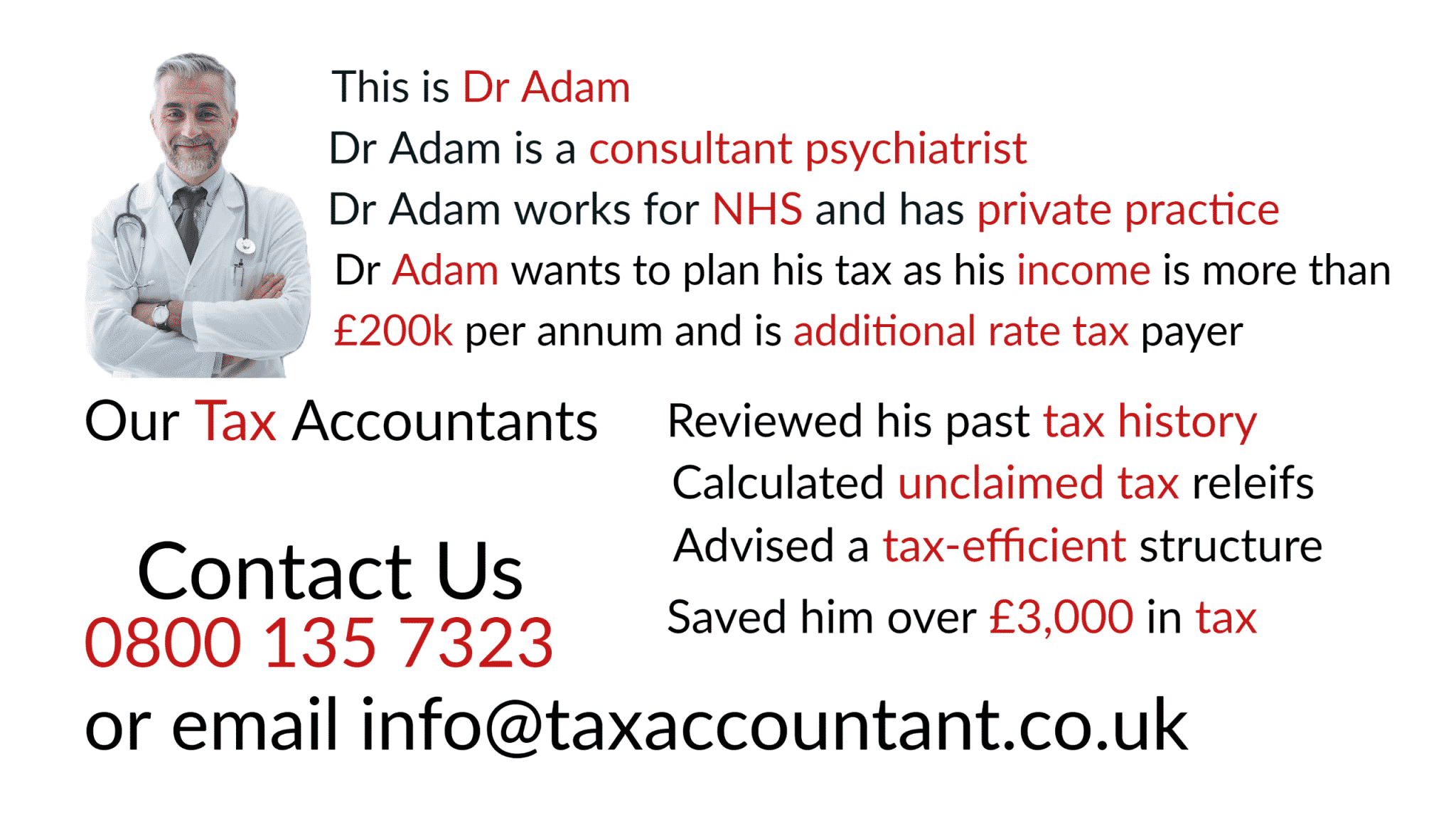

You can actually go to the search solution of Financial advisor near me or go to taxaccountant.co.uk for more details. What is still important is the fact that working with a tax accountant is a smart judgement.

For additional information about Personal Tax Accountant take a look at this popular web portal: click here

Search engine for touristic excursions to any place in the world

Search engine for touristic excursions to any place in the world